Welcome to the resource library for Phase IV participants. The following information provides a deeper dive into each of the topics from this phase.

Before You Negotiate

Generally, there are three things you need to do before you negotiate: do your research, know yourself, and consider the offer. Know your stuff before you step foot in the first interview. Better yet, know the organization and your market value before you apply for the job.

Research

Let’s start with research. Before you can effectively negotiate a salary offer, as a new graduate, it is imperative that you do your research to determine if the salary offered needs to be negotiated. Many entry-level salaries are not up for negotiation. The organizations that hire entry-level graduates do their own research and know the market value.

Yourself

Next, know yourself. A job applicant or employee must know them self and what they bring to the table before they are able to successfully negotiate. If they have no negotiating power, then the negotiation will break down and more than likely fail. Students must evaluate their skills, strengths, weaknesses, likes, and dislikes, and be prepared to discuss them thoroughly in the interview process and negotiation stage.

Consider the Offer

Lastly, you need to consider the offer. When considering an offer, be sure to consider more than just the salary. Consider other parts of the offer such as benefits, bonuses, and incentives. Just because the initial salary is not as high as you’d like does not mean the offer is not a good one.

Planning Counts

As you begin your job search, and begin to consider salary offers, there are somethings you need to know.

- Market Salary: This is the average salary that someone currently in this position makes annually. There are many places where you can research salaries. Try your career center first. Many times, career centers have salary surveys specific to college students and national surveys that are published quarterly. Also, check salary websites. Two of the more popular sites are the Salary and Cost of Living Wizards at www.salary.com or www.salaryexpert.com.

- Budget: Next, it is important to come up with a budget that suits your lifestyle, and to know your bottom line. Don’t forget to consider rent, utilities, food, car payment/transportation, insurance, savings, and entertainment.

- Skills and Accomplishments: Be ready to discuss your skills and how they relate to the job. You need to have specific examples to highlight how you have used your skills. If you had to list skills that you could add as an employee, what would you say?

- Never Mention Salary First: If asked, state that it is negotiable. See if the HR (human resources) representative will give you the salary initially and then work from that point.

- Never Lie About Your Past Salary: If you feel you were under-compensated, then state the reasons why, but don’t be negative.

Are Salaries Really Negotiable?

Some salaries are negotiable, and some are not. It depends on several circumstances.

Negotiable or Not?

- In general, the higher-level management and executive positions offer the greatest opportunities for negotiation.

- Entry-level salaries are less negotiable than mid-level.

- Most entry-level salaries are subject to very little if any negotiation, perhaps a few hundred dollars. Employers will usually stick within the given range during negotiations and will rarely exceed this amount.

With these circumstances in mind, you need to really think about it before you negotiate. Nowadays many entry and mid-level position postings include the salary range in the job listing. Usually, you will get a feel for what the starting salary is during the interview process. You will also have a good feeling on whether the salary is up for negotiation. Know what you are willing to settle for and be willing to walk away from the offer if it does not meet your expectations.

Answering the Salary Question

We all think we’re priceless, but how much does a company think we are worth? One of the most difficult questions to answer is: What are your salary expectations? Through real interview scenarios, this video shows exactly how a student should approach the sticky salary question. Video transcript.

Research Counts

Research counts and that point cannot be stressed enough. Without adequate research, you probably won’t even be able to get the negotiation stage. In fact, you probably won’t even get through the first interview if you have not researched the organization, the industry and salaries.

Research Resources

- One of your first items for research should be salary websites, like www.salary.com or www.salaryexpert.com.

- Many college career center libraries and local libraries will have published salary surveys with current information. Many also have information on graduates from your college for the last three years. Be sure to ask what sources are available.

- Simply checking the want ads will sometimes give you an idea of what the range is for a position. Online job listing sites like www.monster.com and www.ziprecruiter.com can also help identify the range of salary for a specific field or location. However, more and more, many employers are not publishing this information in their initial employment advertisements but saving that information for the formal position description or the interview process.

- Network with alumni from your school. Usually, there is some type of online community or contacts available through your college’s alumni office. Take advantage of your alumnus status and get involved with the alumni chapter where you want to relocate.

- Friends and other networking contacts include past employers, family, chapter alumni, and acquaintances… You never know who is going to have the most valuable information to assist you with your job search and negotiation strategies. Ask your friends in similar positions what their entry-level salaries were.

Considering this information in advance should help you develop an initial range of what to expect from jobs your interested in. Both what’s typical and what you feel like you would need to accept an offer.

LinkedIn

Similarly, LinkedIn is a great way to give and request recommendations. Asking a supervisor that has previously given you a positive written or verbal evaluation to summarize that information in a short recommendation on your LinkedIn profile is a good way to give potential employers a glimpse at your strengths and previous on-the-job performance.

LinkedIn can be a great resource in the job search process – finding people you know in similar positions, connecting with those who work at the company you’re interested in, and showcasing your experience as a digital resume for hiring managers to review. LinkedIn can be used…

- For extending your personal network to include others with similar experiences (e.g. went to your college, was in the same clubs) or who work at companies or in positions related to the field and position you are seeking.

- As a digital resume and opportunity to highlight your most relevant accomplishments.

- To draw potential employers to you. Employers are routinely scanning LinkedIn profiles of applicants to get a sense for their experience and abilities.

Joining the Sigma Nu Fraternity, Inc. group is a great way to get connected to over 10,000 Sigma Nu members and learn about job postings and career advancement tips. “Ask to Join” the group at https://www.linkedin.com/groups/36768

The Sigma Nu Mentor Network

Another source for your research is the Sigma Nu Mentor Network – an on-demand mentoring platform focused on professional and career development. The Sigma Nu Mentor Network is a prime opportunity for collegiate members and young alumni to access personal career coaching from experienced alumni who have worked at top companies across different industries and to expand their personal network. Whether they are just beginning to identify a career path, searching for their first "career" job, or if they are looking to make a career switch, the Sigma Nu Mentor Network is available to all members to network and learn from those alumni who have "been there and done that."

Learn more about the Sigma Nu Mentor Network here. You’ll find the steps for creating an account, booking a consultation, and connecting with career advisors. More detailed information on using the platform is available here.

The Mentor Network also includes a webinar library with career overviews, how-to-guides and samples of typical interview formats, and deep dives on the job search. These recorded sessions cover topics from industry insights, to help with interviews, resume, LinkedIn, and the job search.

Know Yourself

What You Offer

There are several personality inventories you can use as a resource. These tests are a great indicator of your strengths and abilities and how these can be applied to your potential in certain careers. However, be very cautious about the results to make sure you understand them and how to convey those ideas to employers.

Some popular personality tests include:

- The Big Five personality traits (free basic test available here)

- DISC assessment (free basic test available here)

- Myers-Briggs Personality Type Indicator (free basic test using the Jung typology available here)

Visit your career or counseling center for more information on personality and career aptitude tests. Find out what’s available, both in terms of assessments and interpreting the results for your use in selecting a career or position that’s right for you.

Think about what you have to use as a negotiating tool. What are your strengths? What do you like to do? Remember that strengths and likes are two different things. You may like to read but might never be an editor, because you may not have an eye for detail or know grammar well enough. It would be a wonderful world if all of us were good at what we liked and could make a career out of it. Also, be ready to discuss and defend your weaknesses. Find a way to turn them into positives or at least describe how you’ve focused on your strengths to overcome your weaknesses or what you’re doing to improve in any deficiency areas that may be key to the position you are seeking.

Know the job and how your strengths and abilities match the requirements. Be able to give examples of what you could do for the organization. In addition, know if you have transferable skills that fit. For example, if you were a waitperson and are applying for a sales position, your communication skills would be called transferable. Even though you weren’t specifically performing sales, you had to know customer service.

Let others speak for you. Past employer evaluations and performance reviews can be used as reference statements that directly relate to the responsibilities of the position you are applying for, such as, "my past employer described me as assertive," or "my friends say that I am an ideas person."

Considering the Offer

NEVER negotiate anything before you have an offer from the company. Negotiations cannot begin until the job can be yours. And, consider the offer. You may not want the job.

If possible, get the offer in writing so you can take some time to look it over. Never accept the offer immediately – you may indicate your initial interest, but always ask for some time (a few hours, days, or up to two weeks) to really evaluate what you want. This is a huge decision that may affect the rest of your life in the short term and even your career in the long term.

There are also some important questions for you to reflect on:

- Does this position fit in with your career plan and will it aid you in getting the job that you want? Even though your first job may not be your dream job, will it put you on the right path?

- Will you need a new wardrobe or have to relocate? If so, you may be able to negotiate a figure that will cover these expenses.

- When are you eligible for a raise? If you are eligible for a review and possible raise in 6 months, you may be able to live with the current offer for that amount of time.

- Is tuition reimbursement included? This could make a big difference in the value of your compensation package.

- If the job requires a move from your college or hometown, what is the cost of living in the area you’ll live in? $50,000 sounds like a lot of money in your college town, but how far will that go in New York or San Francisco? Location matters as it drives costs for things like rent, utilities, gas, groceries, even eating out. There are several Cost of Living Calculators available online. Check out on or more (like this one) to help you figure out what to expect.

Benefits

Benefits can add about 30% to your compensation package. Some important areas to review are:

- Health Insurance – Does the company offer a health plan? Is it a co-pay or high-deductible model? Note that most high-deductible plans can be coupled with a health savings account (HSA) that allows you to contribute pre-tax dollars to use for eligible health expenses.

- 401 (k) Plan – Does the company offer a retirement plan? How much does the employer match your contribution (3-6% is typical)? How long is the vesting period/schedule (i.e. how long do you have to contribute/be employed in order to keep 100% of the employer’s contribution when you leave the company)?

- Cafeteria Plan – Does the company offer pre-tax deductions?

- Childcare – Does the company provide childcare? While this might not be a concern at the moment, if you like the company and decide to stay it could be an important consideration later.

- Flextime – Does the company allow you to start work at an earlier or later time?

- Stock Ownership Plan – If the company is publicly traded, does it give stock as compensation?

- Telecommuting – Does the company allow you to work from home?

- Tuition Assistance – Does the company assist with education?

Reasons to Negotiate

Take a moment and think about some of the reasons that you should negotiate.

Here are some of the main qualities you may have for successful negotiation. If you do not bring at least one of these to the table, you might have a tough time negotiating a higher salary.

- Prior Career-Related Experience: If you had internships related to this position while in college, this could increase your worth, especially if the internship was with the offering company. Many times, company interns who accept full-time employment will be offered a higher salary than those who did not intern with the company.

- Demand for Academic Major: If there is a demand for your major and the market is very competitive, then you may have some negotiating power (this is typically true in STEM or technical majors).

- Grades and Honors: Strong grades and academic honors may or may not be a good basis for negotiation. If this is your strategy, have at least one of the other things in this list to add to your academic career.

- Other Job Offers: Sometimes you can use another job offer you have from a competitor as negotiating power. Try not to name names; you don’t want to burn any bridges in case you find yourself job hunting again.

- Campus Involvement: Employers also look strongly at your involvement on campus. But, it is not good enough to just be a member of an organization. Be able to show how you made an impact in the organization, it will give you more of an edge.

Negotiating

Now it’s time to negotiate! At this point, you should have evaluated the offer and know that you have some negotiating strength because of your career related work experience, major, grades, involvement, etc.

Don’t forget to have a minimum salary figure in mind before you go into the first interview. And, never negotiate before you have been offered the position.

If the employer asks you about salary expectation, try not to give a specific number. Say “open” or “negotiable.” (e.g. “I know that we will be able to work out an adequate salary as soon as we see a mutual fit between me and the position.”)

Try to get the employer to name a figure first. Then you can work from that number when it is time to negotiate. By using this strategy, you won’t overstate or understate your worth because you have a guideline established by the employer. If you have to provide a number, go with a range, using the bottom number as what your research tells you would need to make in order for the job to fit your expected lifestyle and typical salaries for the position and your experience level.

Always take time to evaluate the offer and gather your negotiating material. The offer may be so good that you won’t have to negotiate, but if you do have to, then you need time to prepare.

Common Questions

Answering the Salary Question

We all think we’re priceless, but how much does a company think we are worth? One of the most difficult questions to answer is: What are your salary expectations? Through real interview scenarios, this video shows exactly how a student should approach the sticky salary question. Video transcript.

The following are some typical scenarios/questions that you may be asked either during the interview process or the negotiation stage. The responses given are very open-ended and put the ball back in the employer’s hands.

Common Question 1: What are your salary requirements?

Summarize the requirements of the position as you understand them and ask the interviewer for the normal salary range.

Common Question 2: How much did you earn on your last job?

Tell the interviewer that you would prefer leaning more about the current position. Add that you are confident that a mutual agreement can be reached if you are the person for the job.

Common Question 3: The salary range for this position is $22,000 – $27,000, is that what you were expecting?

Tell the interviewer that you were expecting $27,000 – $32,000 (i.e. make the top number from their range the bottom number of the new range and match the spread to develop the new top number).

Common Question 4: The salary is $1,900 per month, is that okay?

Don’t look excited or disappointed. Restate the salary and pause to give the employer an opportunity to increase the offer. If the employer does not increase the offer, respond in fashion like Common Question 3 – tell the interviewer that you were expecting $2,400 per month.

Inside the Mind of the Interviewer

The terror-inducing, fright-provoking job interview! Some consider an interview as a battle of wits with the recruiting director. This video debunks the myth of the evil recruiting director and shows how to enter an interview relaxed, prepared, and confident. Video transcript.

Answering “What Are Your Weaknesses?”

Most of us dread that infamous interview question: “What are your weaknesses?” In this fun, enlightening video, see how to avoid the “canned” answers and how to deliver an intelligent and thoughtful response. Video transcript.

Negotiating Revisited

The following are some further thoughts, suggestions, and advice regarding the negotiating process:

Negotiate on the Basis of Qualifications: It is imperative that you have negotiation power before you consider trying to ask for a higher salary. You need to negotiate based on your qualifications as they pertain to the current position, not because of your needs. Because you may come out of college with credit card debt, school loans, and other financial obligations is not a reason to negotiate.

State a Salary Range: Use the information that you received from the employer on a typical salary for this position as the bottom end of your range, and add $5,000 to that for your salary range. Always give a range so the employer has something to work with. And, be ready to defend your reasoning for wanting more money. If you have prepared and made a thorough self-assessment and salary research, then you should be ready to present your arguments.

Be Ready to Defend Your Position: If at first you don’t succeed with salary negotiations, consider other perks. If a typical employee review does not come up for a year, ask to have yours in 6 months with the understanding that if you are exceeding expectations, you could be considered for a raise at that time. Maybe you could ask for a higher relocation package, more vacation, or tuition reimbursement. Be willing to compromise with the employer, but also be prepared to walk away.

Take Time to Consider the Final Offer: Take the time you need to reflect on the pros and cons of the position and opportunities for advancement.

Considering the Offer

Congratulations, you have an offer! It is common to accept the offer verbally over the phone. However, always ask the employer to send you the offer and all the specifics in writing. By taking that action, there will be no confusion on what you are expecting.

The offer should include salary, vacation, benefits, perks, start date, time, and where you should go on your first day. It should also mention moving expenses (if any) and how they will be covered. Note that many times, employers will not offer college students moving expenses, because they will likely have to move anyway.

It is also a good idea to reiterate the specifics of the offer in a letter to the employer when accepting the position. Restate the offer, including salary, vacation, benefits, perks, start date, time, and location. Again, this leaves no room for confusion and any oversights can be caught before you start the job.

Review any contracts (and the fine print) before signing the dotted line. If you prefer, have an attorney look them over also.

It is common courtesy to write to any employers you are still interviewing with and withdraw from the process. You never know what may happen and you might want to work for one of those organizations in the future. Take the time and make the effort to pay attention to this detail so you don’t burn any bridges.

Wrap Up

By following the simple strategies described in this session you will be better prepared to negotiate any salary offer you receive following graduation. In its simplest form, effectively negotiating a salary offer is a three-part strategy.

- Do your research

- Know yourself

- Consider the offer thoroughly

Reflection Questions & Application Ideas

Reflection Questions:

- What are your strengths as a potential candidate for employment? How can they help you on the job and in the negotiation process?

- What are your weaknesses? How can you sell your weaknesses as strengths?

- What does a ‘successful’ negotiation look like?

Application Ideas:

- Create or update your resume. Go to the career center on campus for advice and assistance in preparing an enticing resume and cover letter that you can use in your job search.

- Create or update your LinkedIn profile. Be sure to include a professional photo and the key points from your resume that apply to the types of positions and companies you are interested in. “Ask to Join” the national Sigma Nu Fraternity LinkedIn group at “Ask to Join” the group at https://www.linkedin.com/groups/36768

- Start researching market rate salary ranges for fields and positions you are interested in. Check the career center for listings or try web sites like www.salary.com or www.salaryexpert.com.

- Create a summary or listing of how your chapter and on-campus experiences translate into the workplace. Determine what skills, experience, and knowledge are transferable.

Creating Opportunities

Studies have shown that people are switching careers at an increasing rate throughout their work life. As you enter the workforce, the probability increases with each year that you will look to either switch jobs or advance in your current field. To do so, you have a choice: 1) Hope, and; 2) Take the initiative and create opportunities for yourself. Developing and utilizing your networking skills will help you in creating opportunities for advancement.

Sigma Nu is a network. Not only is it an organized collection of your personal contacts and your personal contacts’ own network, but with chapters across the country and alumni across the globe the links between you and every other Sigma Nu brother run in every direction imaginable. With such a vast network, though, the question becomes how to access that network. The Sigma Nu Mentor Network is one answer to that question.

The Sigma Nu Mentor Network

The creation and expansion of social media was a major first step in the elimination of a lot of the barriers that existed in traditional networking. The Sigma Nu Mentor Network builds on the social media concept but focuses those networking opportunities to the Fraternity at-large. Put another way, the Sigma Nu Mentor Network allows you to network and seek career/professional advice from alumni brothers regardless of their chapter or location in the world. Your personal network is vast, simply because of your membership in Sigma Nu, accessing and using that network is key to you unlocking the benefits of that network.

The Sigma Nu Mentor Network is an on-demand mentoring platform focused on professional and career development. The Sigma Nu Mentor Network is a prime opportunity for collegiate members and young alumni to access personal career coaching from experienced alumni who have worked at top companies across different industries and to expand their personal network. Whether they are just beginning to identify a career path, searching for their first "career" job, or if they are looking to make a career switch, the Sigma Nu Mentor Network is available to all members to network and learn from those alumni who have "been there and done that."

Learn more about the Sigma Nu Mentor Network here. You’ll find the steps for creating an account, booking a consultation, and connecting with career advisors. More detailed information on using the platform is available here.

The Mentor Network also includes a webinar library that includes career overviews, how-to-guides and samples of typical interview formats, and deep dives on the job search. These recorded sessions cover topics from industry insights, to help with interviews, resume, LinkedIn, and the job search.

Take advantage of this new networking opportunity by creating your account and connecting with a Sigma Nu advisor today.

LinkedIn

Similarly, LinkedIn is a great way to build and manage your online network of fraternal, academic, and professional contacts. LinkedIn can be a great resource in the job search process – finding people you know in similar positions, connecting with those who work at the company you’re interested in, and showcasing your experience as a digital resume for hiring managers to review. LinkedIn can be used…

- For extending your personal network to include others with similar experiences (e.g. went to your college, was in the same clubs) or who work at companies or in positions related to the field and position you are seeking.

- As a digital resume and opportunity to highlight your most relevant accomplishments.

- To draw potential employers to you. Employers are routinely scanning LinkedIn profiles of applicants to get a sense for their experience and abilities.

Joining the Sigma Nu Fraternity, Inc. group is a great way to get connected to over 10,000 Sigma Nu members and learn about job postings and career advancement tips. “Ask to Join” the group at https://www.linkedin.com/groups/36768

Also, check out this article for tips on maximizing your profile and network on LinkedIn.

What is Networking?

Networking is a skill that, if used well, can help you grow and advance both personally and professionally. To understand networking, we need to start with the definition of the word.

Networking Defined

A network provides a path, a way of getting from point A to point B in the shortest possible time over the least possible distance. Another way of looking at networking is that it is first finding whom you need to get to know, what you need in any given situation, and then helping others do the same.

Networking is a way of connecting the dots between A and Z without having to go through C, D, E…W, X, and Y.

In a network, the interconnecting links can be lateral, vertical, or diagonal. Each link is no more or less important than another. The whole structure is designed to minimize the distance between any one point and another. Each part reinforces the other. My network is your network; my parents’ network is partially my network and so on, and so on…

Another definition of networking that is important for you to know comes from Harvey MacKay, one of the nation’s leading experts on networking. MacKay has a maxim which states, “A network is an organized collection of your personal contacts and your personal contacts’ own networks.”

In short, MacKay’s maxim relates back to our earlier definition that networking is finding fast who you need to get to know, what you need in any given situation, and helping others do the same.

Networking Your Way To A Job

Students are advised time and time again to network, yet they simply don't do it. The main reasons are that they are intimidated, and they are not entirely sure what to do. In this video, learn a step-by-step plan to network that eliminates all the fear and uncertainty. Video transcript.

Five Conclusions

Let’s turn to focusing on conclusions. There are five conclusions that are important for you to learn about as they apply to networking. Consider networking from an economic perspective. Networking is important all the time, when the economy is strong and when it’s not so strong.

Have you ever known someone who was laid off as a result of changes in the company’s structure? The media continually reports on issues such as downsizing. An article from The New York Times included a paragraph emphasizing the importance of networking:

“As an officer in charge of operations for the Standard Charter Bank, Mr. Allen had to dispose of one of the three currency traders in the Toronto branch. The consensus choice happened to be a woman who was indisputably the top performer but had the weakest political bonds. ‘I knew she was the best in the department,’ he said, ‘But she had not networked. And I had to inform her that she was terminated. She looked at me with tears in her eyes and said, ‘But Charlie, you know better.’ I will never forget what she said and how she looked that day.”

Setting aside whether or the operations officer made the right choice based on performance, the reality is that there are several lessons that can be learned about networking from that article:

- Talent alone will not save you in today’s economy.

- The traditional advice alone – more training and education – will not save you.

- The government will not save you.

- No matter how self-reliant, dedicated, loyal, competent, well educated, and well trained you are, you need more than you to save yourself.

- You need a network. You need your network. Every day. A network will help you deal with some of life’s minor annoyances as well as your most challenging problems. Your network can provide role models, advise you, comfort you, and provide you with financial assistance, intellectual and social resources, entertainment, and a ride to work in the morning.

As you review these conclusions, especially the fifth one, you should be able to picture someone, or a group of people, in your mind: Your friends! In many ways that’s what a network is, a group of friends. However, in utilizing a network you must be able to separate the various people in your network between personal, professional, and those that are both.

It makes sense that our friends are a part of our network because of what a network can do for us:

- Replace weaknesses of individuals with the strength of others

- Give crucial feedback that is needed

- Help you know your opposition

- Help you expand your network

- Enrich your life

- Provide you with knowledge and experience

- Help you help others

- Help provide job security, and

- Make you look good

The Four Elements of Networking

Harvey MacKay created the Four Elements of Networking. These elements are important for you in understanding how to use a network to its maximum potential.

Element 1: You Give – You Get: Reciprocity

A network is not about mutual admiration. It is a relationship formed to meet the needs of both parties on an ongoing basis. You give; you get.

Reciprocity is what makes a network work. If every member focused on what they could do to help others the network would be successful.

While some networks are based on friendship, others are based on necessity. You network with friends because you like them. You network with others because they have something you need, and vice versa. The point is that if you only do business with people you like, you won’t get as far as you’d like to.

Element 2: Interdependency

One of the myths of modern business is that corporations can establish formal business structures that define the limits of these networks. For instance, every chain of fast food restaurants has a corps of managers. All managers share certain responsibilities for performing and reporting. From time to time, the company will bring them together for training, or to inform them about new corporate policies.

Knowing people who have specialized skills and knowledge that you don’t allows you to focus on what you’re best at and rely on your network for help in other areas. None of us can be great at everything, so it’s good to know who you can trust and call in when it’s time to review a contract, fix an overflowing toilet, or tell you where to invest your money for the greatest return.

Element 3: Sharing It – Information and Knowledge

Have you ever heard of the meticulous spender? He’s the guy with the little black book, who wrote down every nickel he ever spent, but never stopped to add it up. Some so-called networks are designed the same way. They have plenty of information, but their systems are not designed to use it.

Element 4: Keeping At It – Keeping Plugged In

If your network is going to work, you have to stay plugged in and keep the wires humming. Keeping plugged in could mean a call or email every month or every other month, sending a holiday card/annual update, or getting together for lunch a couple of times each year. In any case, you need to be a resource for others in your network. Keeping plugged in helps you focus on them and their needs.

Networking Tips for Events

Interacting with Others

So far, we’ve covered the definition of networking and the four elements of networking. Now we want to focus on where and how to network. As you enter the work force or graduate school, you will have a number of opportunities for networking.

Many of these will focus around your company or social groups. The first step, though, is working the room and meeting people.

Imagine yourself in a scenario where you are in an environment with some great potential networking possibilities. So, what’s next? Coming up with that effective opening line for meeting people.

The quest for a great opening line may be as old as human kind. Too often, we lose an opportunity to meet someone because we spend time trying to think of the perfect opening line – when there is no such thing. What you say depends on who you are, the person with whom you are talking, the circumstances, the response you want to get, and what pops into your mind. It is far better to say something than to wait for the perfect clever remark. The best opening line of all may be a SMILE and a friendly HI or HELLO.

When it comes to opening lines, there are three areas that you can always focus on:

A Statement: One of the first things you can do is to look around the room. Observe the situation. What is happening? Does there seem to be a good crowd? Do they seem to be enjoying themselves? What do these people have in common? Observations about any of these things might be good conversation starters. Saying something humorous or unexpected is even better. It is best to avoid negative comments. That way, you don’t give the impression that you are a whiner. Avoid statements like: “The food looks pathetic,” and, “This place is not as nice as I thought it would be.” Instead, go for upbeat, unusual observations that will pique people’s interest.

A Question: The questions you ask should be relevant. Do your homework to find out about the group and the people who will be attending the event. Even if you don’t know much about the organization, you can ask questions like: “Are you a member of this group?,” “How would you suggest I become involved?,” or “How do you know the bride (honoree, groom, couple, politician, etc.)?” the questions should be open-ended enough to encourage a response.

A Pleasant Self-Revelation: Disclosing something about you is a good way to establish your vulnerability and approachability. Self-disclosures should be generally positive.

Some other good topics to comment on are:

- The facility

- The food

- The organization

- The guest of honor

- The charity/community that will benefit from the event

Mingling and Circulating at Events

There is difference between including yourself in other people’s conversations and intruding on them. Getting into a conversation that is already underway requires some nerve, but also some sensitivity. Watch people’s body language and listen to the tone of their conversation for clues. Some advice for including without intruding:

- Avoid approaching two people who look as though they are having an intense conversation. If they seem totally preoccupied, you can assume that they are flirting with some profound ideas or with each other.

- Approach groups of three or more. Position yourself close to the group. Give only facial feedback to the comments being made. When you feel yourself included, either by verbal acknowledgement or eye contact, you are free to join in on the conversation.

- Be open to others who “want in.” When you see someone on the periphery of your conversational group, remember how uncomfortable you feel in that situation.

The Buddy System

The buddy system is a technique for interacting at an event with a friend or partner. It can help you have more in-depth conversations and move easier throughout the event. Working as a team can be less stressful, allow you to step away and rejoin a conversation in progress, meet more people at the event, and spread the workload of driving conversation and connections.

Introducing People

It’s always a good idea to introduce the person of higher title/standing to the person of lower title. For example, introduce someone with an advanced degree first, “Dr. Jones, please meet my co-worker Bill.”

Remembering Names

Repetition helps. Repeat the name back to the person as quickly as you can in the conversation (e.g. “Nice to meet you, Brad.”) and then try to use it periodically throughout the conversation. Another idea is to try to find something about the person to help you remember their name (something they are wearing, a physical feature, or some fact about them that you can connect back to their name).

Another trick is to make notes immediately following a conversation or networking event to capture the details of the conversation (e.g. name, company, position, personal fact, topic/anecdote/fact from the conversation). Referring back to this information later in a follow up message or second encounter can show that you valued the first meeting.

Exiting a Conversation

Always leave a conversation by saying something to the person you were talking to. This could be as easy as, “It’s been great talking to you. I’m going to get another drink / go to the restroom / I need to find my friend.”

Keys to Lively Conversation

From How to Dig Your Well Before You’re Thirsty by Harvey Mackay

Even people who make wonderful self-introductions can be stymied by the next step…making conversation. Initial impressions are based on our ability to communicate and converse. The trick is to do so with ease, interest, and energy. “Nothing is so contagious as enthusiasm; it moves stones, it charms brutes.” This statement is attributed to Edward Bulwer-Lytton in 637 of the Best Things Anybody Ever Said.

Sincere interest in people is the most important part of being a good conversationalist. If we are just waiting our turn to speak or manipulating others into talking so we can get information, they will know it. We can listen to others not only with our ears, but also with our eyes and our whole face to let them know we care about their responses, feelings, and thoughts. Be in the moment. Make those minutes with each person memorable – by giving your undivided attention.

Your first topic of conversation with a new person will NOT be nuclear disarmament, abortion, or the world economy – unless you are at an event organized around these issues.

Key 1: Read One Newspaper a Day

Reading a newspaper each day is a must! Some people balk at this suggestion – until they try it. This is not only the best way to build the knowledge bank from which to draw conversation, it can also be fun, entertaining, and even addictive! Once you start, it’s hard to stop. Information is power. Building your “knowledge bank” lets you contribute to conversations with more ease and interest. Do you have to be an expert on everything? Absolutely not. But you must be well read enough to initiate or contribute to conversations. You need enough knowledge of general topics to pose intelligent questions.

Key 2: Clip and Collect

One way to show your contacts that you are thinking of them is to share relevant articles. Clipping and collecting articles and cartoons contribute to conversation – whether the clippings are poignant, satirical, relevant, or informative.

Key 3: Read Newsletters

Sometimes you will be invited to events sponsored by organizations with which you are not entirely familiar. Such events as charity fundraisers, political dinners, or clients’ holiday parties may require some special preparation. The best way to get a handle on the organization is to read its newsletter or professional journal. These publications can be invaluable resources. If you invest the time to read them, you will be well compensated. You will not be an outsider, you will be familiar with the group and its people, and have all the information you to ask questions and start conversations.

Key 4: Take Note and Take Notes

Other people’s clever remarks and stories can be interesting or good conversation starters. These statements or situations come from friends, family, colleagues, children, and people on the street – practically anyone. One advantage of these stories is that the hero or heroine is always someone else. In order to use these stories and situations as conversation starters, we need to remember them. Some people write them down in a journal; others carry a small notebook and jot ideas down.

Key 5: Use Humor

Humor is a special way of bringing people together. It can establish rapport and warmth among people. You don’t have to be a standup comic to use humor. Humor can be defined in two ways. First, it is the quality of being funny, and second, it is the ability to perceive, enjoy, or express something funny.

Key 6: Listen Actively, Not Passively

All of us need to be good listeners, and that means more than just looking at someone while he or she talks. Active listening means hearing what other people say, concentrating on them and their words, and then responding. When we really concentrate on that one person and are in the moment, we improve our chances of remembering both the person and the conversation. Some things to focus on that will help your listening: eye contact, nodding, smiling and/or laughing, asking relevant questions that indicate interest, making statements that reflect similar situations, facial expressions, and body language that is open and receptive.

Questions for Specific Events

Some events and specialized scenarios require specifically relevant questions. See below for some conversation starters.

Political Fundraiser

- What made you decide to support this candidate/issue?

- How have you been involved in the campaign?

Charity Benefit

- What’s your connection to [the charity]?

- How did you get involved with [the charity]?

Professional Conference

- How long have you been in the field?

- How did you get into the field? What do you like most about the work?

- What are your specific research interests?

- What are you working on right now?

Building your Network: Keeping Track of Information

Now that you know some great people, how do you keep track of the info? It is not enough to meet people; you need to record their info so you can continue to build your relationships. One way to do this is by using index cards to keep track of your network, or another way would be to keep a contact list or address book, identifying which contacts are social/personal and which are professional. The point here is that it is vital that you keep information regarding the people in your network to help identify who can help you, and how they can help you, in any given situation.

LinkedIn is a great way to manage your professional network and joining the Sigma Nu Fraternity, Inc. group is a great way to get connected to over 10,000 Sigma Nu members and learn about job postings and career advancement tips. “Ask to Join” the group at https://www.linkedin.com/groups/36768

Go Prospecting

Once you graduate, you’ll need to make networking a priority. There are many places in addition to the workplace that you could use to network.

- Alumni Clubs: These are great! One of the first things you should do as a new graduate is join the alumni club for your college/university in the city where you live. Alumni clubs usually provide a wide range of activities including networking, sporting, and social events. It is a great opportunity to get to know other alumni from your university, keep connected and meet people.

- Industry Associations: If you are serious about your career and career advancement, you should take steps to join whichever industry associations are appropriate. Talk to your co-workers, your supervisor, and read publications in your field, to help determine which groups and events are good to join. Many industry associations sponsor conferences and other opportunities for mentoring.

- Social Clubs: Many larger cities have social groups for young adults. These include athletic clubs (which sponsor athletic leagues), community service groups (such as Jaycees), and social clubs (to help meet people). When you move to your new community, dive in and start meeting people! This includes checking to see if there’s a Sigma Nu Alumni Club in your area to keep you connected to the Fraternity even if you’re living far from where you went to school.

- Hobbies: Chances are you have a number of hobbies and interests that you have let slide while you’ve been in school. Now that you are ready to graduate, it is time to get back into them. The web has several resources for finding clubs and interest groups in all areas. Whether you want to try a mini-triathlon, get back into mountain biking, hiking, or camping, there is a group near you that you can join.

Networking Commandments

From How to Dig Your Well Before You’re Thirsty by Harvey Mackay

- Thou Shalt Prepare – Attitude, focus, self-introduction, conversation, business cards, smile, and handshake

- Thou Shalt Attend – RSVP and Go! Act like a gracious host.

- Thou Shalt Try Strategies That Feel Comfortable – Read nametags, go with a buddy. Talk to white-knuckled drinkers. Approach and be approachable. Smile. Allow for serendipity. Listen. Care. Extricate courteously and circulate gracefully. Follow up. Call or send “thank you’s.”

- Thou Shalt Say Something…Anything – Don’t wait; initiate. Take the risk; the rewards are yours. Listen with interest to the response. Smile and make eye contact.

- Thou Shalt Mind Thy Manners – Learn old and new etiquette and brush up on your manners. Acknowledge others. Treat everyone nicely.

- Thou Shalt Avoid The Common Crutches – Do not arrive too late. Don’t arrive too early. Don’t drink too much. Don’t gorge at the buffet table. Don’t misuse the buddy system by joining yourselves at the hip.

- Thou Shalt Remember The Three E’s – Make an EFFORT. Bring your ENERGY. Exude ENTHUSIASM.

- Thou Shalt Dress Appropriately – Unsure? Ask!

- Thou Shalt Remember The Four C’s – Courtesy. Charm. Caring. Chutzpah.

- Thou Shalt Bring Thy Sense Of Humor – Use the A.T.&T Test (is it Appropriate, Tasteful, and Timely?)

Wrap Up

Networking can help you make contacts that can help achieve all you want in your life. Contacts that can help with your professional career, find your partner, advance your interests and hobbies. But, you need to make networking a focus of your life, and it needs to start NOW.

An important point to remember is that you can learn a lot about a person in a very short period. Never pass up an opportunity to meet new people.

As a leader and a member of Sigma Nu, we want to challenge you to begin to develop your network of contacts. By helping others, you are helping yourself; and, building a group of friends and colleagues you can depend on, in good times and when you are having challenges.

Reflection Questions & Application Ideas

Reflection Questions

- Who do you consider to currently be in your network?

- How do you see this network helping you establish a career?

Application Ideas

- Create or update your LinkedIn profile. Review relevant tips to make your profile stand out

- “Ask to Join” the national Sigma Nu Fraternity group at www.linkedin.com/groups/36768

- Keep plugged in to your current network by checking in on a regular basis (e.g. email, lunch, holiday cards, and phone calls).

- Attend a job fair. Meet some potential employers and have purposeful discussions about what they do and how you could add to their team.

- Create a list of the types of people and specific individuals that you would like to add to your network. Brainstorm ways to begin making those connections.

Servant/Leader

Throughout the early part of the twenty-first century, we are seeing traditional autocratic and hierarchical models of leadership yielding to a new model – one that attempts to enhance the growth of others and improve the caring of our institutions through a combination of teamwork, community, personal development, and ethical decision making. This emerging approach to leadership is called Servant Leadership.

As you move through this session, try to concentrate on two words: Servant and Leader. These words are usually thought of as opposites. When opposites are brought together in a creative and meaningful way, a paradox emerges. Here the words servant and leader have been brought together to create the paradox of “servant leadership.” This idea is growing in many institutions, organizations, and companies, as well as in the hearts of individuals. Servant leadership is providing a framework within which many individuals are helping to improve the way we treat those with whom we work.

Servant Leadership

Leadership goes beyond being the person in charge, and beyond the authority that comes with holding a position. The concept of servant leadership was created by Robert K. Greenleaf.

What is Servant Leadership?

The idea of servant leadership came out of reading Herman Hesse’s “Journey to the East.” In this story, we see a band of men on a mythical journey, probably also Hesse’s own journey. The central figure of the story is Leo who accompanies the party as the servant who does their menial chores, but who also sustains them with his spirit and his song. He is a person of extraordinary presence. All goes well until Leo disappears. Then the group falls into disarray and the journey is abandoned. They cannot make it without the servant Leo. The narrator, one of the party, after some years of wandering finds Leo and is taken into the Order that sponsored the journey. There he discovers that Leo, whom he had known first as servant, was in fact the titular head of the Order, its guiding spirit, and a great and noble leader.

To Greenleaf, the story clearly said that the great leader is seen as servant first, and that simple fact is the key to his greatness. Leo was actually the leader the whole time, but he was servant first because that was what he was, deep down inside. Leadership was bestowed upon a man who was by nature a servant. It was something given, or assumed, that could be taken away. His servant nature was the real man, not bestowed, not assumed, and not to be taken away. He was servant first.

One of the beliefs of servant leadership is that as individuals, we need to focus on the communities that we are a part of, especially the largest community, reflect on the challenges and ask, “What can I do about it?”

It is no longer acceptable to ignore what is happening around us. There is a need for people who are committed to serving others and making a difference.

Emerson once said, “…every wall is a door, let us not look for the fjord, and the way out, anywhere but in the wall against which we are living. Instead, let us seek the respite where it is – in the very thick of battle.”

How does this relate to Sigma Nu? In our Ritual and in the preamble to our Creed, it talks about developing the potential in others. It talks about a commitment to citizenship. And part of being a good citizen is taking an active role in our communities, where we go to school, work, and after graduation, where we live. If we are to develop others into ethical people with values and a sense of commitment to community, we must start with where we live.

So, who is the Servant Leader?

The servant leader is servant first – as Leo portrayed. It begins with the natural feeling that one wants to serve, to serve first. Then, conscious choice brings one to aspire to lead. He is sharply different than the person who is leader first, perhaps because of the need to assuage an unusual power or drive, or to acquire material possessions. For such, it will be a latter choice to serve – after leadership is established. The leader-first and servant-first are two extreme types. Between them are shadings and blends that are part of the infinite variety of human nature.

The difference manifests itself in the care taken by the servant-first to make sure that other people’s highest priority needs are being served.

The best test, and difficult to administer, is:

- Do those served grow as persons?

- Do they, while being served, become healthier, wiser, freer, more autonomous, more likely themselves to become servants?

- Do they develop their potential?

- Truly care for others?

- Focus on collaboration and on building consensus?

- And, what is the effect on the least privileged in society; will he benefit, or, at least, will he not be further deprived?

Role Models

Now that we have discovered who the servant leader is, we need to focus on taking action. “Leadership is action, not position.” This quote shows the strength of servant leadership in action.

Your Role Models

Think of people who have made an impact on your life or in the lives of others whom you knew well. Think of people who taught you lessons in life and helped develop who you are as a person. Bring to mind people who have been models of service to you, such as good teachers, wise friends, coaches or leaders. It is important that you think of people whose motivation was doing things to help others grow and develop.

- What are the qualities that made them of service to others and important role models for you?

- What did they specifically do to help others?

- What do/did you admire about them?

- If you could take a lesson in life, or a quality they possessed, from them and use it in your own life, what would it be?

The Characteristics of Servant Leadership

Before you go any further, take a moment to yourself and answer the following questions:

- Why spend time on the topic of servant leadership?

- Why would this topic be covered in the fourth phase of LEAD, before you graduate and go out in to the working world?

The Characteristics of Servant Leadership

Servant Leadership embodies ten characteristics. A description or example of each follows, along with a reflection question for you to consider as you review each characteristic.

Listening and Understanding

A very able leader was made the head of a large, important, and difficult to administer public institution. After a short time, he realized that he was not happy with the way things were going. His approach to the problem was a bit unusual. For three months, he stopped reading newspapers and listening to news broadcasts, and for this period he relied wholly upon those he met in the course of his work to tell him what was going on. In three months, his administrative problems were resolved. No miracles were wrought; but, out of a sustained intentness of listening that was produced by this unusual decision, this able man learned and received the insights needed to set the right course. And, he strengthened his team.

Reflection: How good are you at listening to others? What can you do to be a better listener?

Acceptance and Empathy

Servant leaders strive to understand and empathize with others. People need to be accepted and recognized for their special and unique talents. One must assume the good intentions of co-workers and not reject them as people, even when forced to reject their behavior or performance. The most successful servant leaders are those who have become skilled empathetic listeners.

Reflection: What can you do to make others feel accepted in the chapter? In other campus organizations to which you belong? How have you done this before?

Stewardship

Peter Block – author of Stewardship and the Empowered Manager – has defined stewardship as, “holding something in trust for another.” Robert Greenleaf’s view of all institutions was one in which CEOs, staffs, directors, and trustees all played significant roles in holding their institutions in trust for the greater good. Servant leadership, like stewardship, assumes first and foremost a commitment to serving the needs of others. It also emphasizes the use of openness and persuasion, rather than control.

Reflection: As a senior, how have you practiced stewardship?

Commitment to the Growth of People

Servant leaders believe that people have an intrinsic value beyond their tangible contributions as members. As such, servant leaders are deeply committed to the personal, professional, and spiritual growth of each individual within the institution. In practice, this can mean encouraging others to take advantage of opportunities for growth, taking a personal interest in members’ ideas and suggestions, and encouraging members’ involvement in projects.

Reflection: How have you helped others to grow and develop as leaders and individuals? How have you been helped in this way by older members and/or alumni?

Foresight

The ability to foresee the likely outcome of a situation is hard to define, but easy to identify. Foresight is a characteristic that enables servant leaders to understand lessons from the past, the realities of the present, and the likely consequence of a decision for the future. It is deeply rooted in the intuitive mind. Thus, foresight is the one servant leader characteristic with which one may be born. All other characteristics can be consciously developed.

Reflection: What can you do to think through possible outcomes for the chapter? Think about a time when you used foresight to see the consequences of your actions.

Awareness and Perception

General awareness, and especially self-awareness, strengthens the servant leader. Making a commitment to foster awareness can be scary – one never knows what one may discover. Awareness also helps with understanding issues involving ethics and values. It enables one to view most situations from a more integrated position. As Greenleaf observed: “Awareness is not a giver of solace – it is just the opposite. It is a disturber and an awakener. Able leaders are usually sharply awake and reasonably disturbed. They are not seekers after solace. They have their own inner serenity.”

Reflection: If someone asked who you are, what would you say? Do you have a personal mission statement? What do you consider your strengths and areas for improvement as a person?

Persuasion

Another characteristic of servant leaders is reliance upon persuasion, rather than positional authority, in making decisions within an organization. Servant leaders seek to convince others, rather than coerce compliance. This element offers one of the clearest distinctions between the traditional industrial theory of leadership and that of servant leadership. The servant leader is effective in building consensus within groups.

Reflection: How are you a “person of influence” in the chapter? What is an example of when you were successful in influencing someone?

Conceptualizing

Servant leaders seek to nurture their abilities to “dream great dreams.” The ability to look at a problem (or an organization) from a conceptualizing perspective means that one must think beyond day-to-day realities. For many, this is a characteristic that requires discipline and practice. Traditionally, managers are consumed by the need to achieve short-term operational goals. A person who wishes to be a servant leader must stretch his thinking to encompass broader-based conceptual thinking.

Reflection: Have you taken time to think of your vision for the chapter? What is your vision? What does having a vision do? How does it affect you?

Healing and Serving

Learning to heal is a powerful tool for transformation and integration. One of the greatest strengths of servant leadership is the potential for healing one’s self and others. Many people have broken spirits (some of these are our brothers who have drifted away from the chapter). Although this is part of being human, servant leaders recognize that they have the opportunity to help make whole those with whom they come into contact.

Reflection: How have you helped others who have drifted away from the chapter? How have you taken time to listen to others or help them share their frustrations?

Community

Servant leaders are aware that the shift from local communities to large institutions as the primary shaper of human lives has changed our perceptions and caused a certain sense of loss. Thus, servant leaders seek to identify a means for building community among those who work within a given institution. Servant leadership suggests that true community can be created among those who work in businesses and other institutions. Greenleaf said, “All that is needed to rebuild community as a viable life form for large numbers of people is for enough servant leaders to show the way, not by mass movements, but by each servant leader demonstrating his own unlimited liability for a quite specific, community-related group.”

Reflection: What do you think helps in developing community?

Having reviewed the ten characteristics of Servant Leadership, consider which you have you used in the past. How and when did you do so?

Using Servant Leadership

The ideas behind servant leadership can be applied to all areas of your life: in business, in government, in public service, and in industry. The characteristic of servant leadership should be used to develop others, to improve the organization you are in, and to benefit the community where you live and work.

Let’s look at how servant leadership can be used in business and industry. The business community has changed a great deal in the last 40 years. The Fortune 500 companies have eliminated some four million jobs, or more, since 1982. Former icons of corporate stability – General Motors, Digital Equipment Company, IBM – have restructured their operations, closed plants, and slashed jobs.

There have been several books published that focus on developing others and making the most of their experiences. As these books indicate, you can use the ideas of servant leadership in all areas of business, whether it is creating an effective vision for the company, developing employees or setting standards for your organization. It begins with you.

Passion: The Core of Servant Leadership

For someone to truly become a servant leader, they must selflessly want to contribute something and make things better. One of the first steps is for each individual to find out what things they are most passionate about and to what causes they would want to give of themselves selflessly.

The facilitated workshop for Servant Leadership contains an activity for identifying, ranking, and action planning around your passions. The questions below serve as a preview for that activity.

- Develop a list of 10 issues you care deeply about. These could be social, family, work, or national issues. The only determining factor is that you care deeply about them.

- Rank the issues according to your depth of feeling for each.

- Select two of the issues you can choose to do something about within the next two years.

- Determine which is most important to you between the two – which offers the greatest opportunity for impact in the next two years?

- Develop and commit to a list of action steps towards addressing the issue you’ve selected.

Taking Action

Individually

It is not enough just to talk about servant leadership. To truly understand it, we need to put it into action. As you know, community service is an expectation for all members in Sigma Nu and in your chapter. However, sometimes we get caught up in “putting in hours” instead of truly making a difference.

Consider making a commitment to an organization and the issue you have chosen from the Passions Checklist. In the next week, contact that organization and ask how you can help. Decide what kind of time commitment you can give and start getting involved.

As a Group

As a group of seniors, select an issue that you are passionate about. Meet with leaders of an organization focused on your issue and explain that you want to help them with a project that can make an impact in their organization. Listen to them and their needs. It is too easy to pick a project that you want, so by listening to the organization’s staff members, you can come up with something that will benefit everyone.

It is vital that everyone in your senior group make a commitment to the project you select. This will be one of the ways that you can make your mark on the community and show everyone in the chapter what you can achieve as a group.

Set Expectations

Whether you expect everyone to give one Saturday a month to the project or one hour a week, you need to set an expectation and stick to it.

Making a Difference

Which Do You Choose To Be?

Twenty-five centuries ago, Lao-tse, a Chinese sage, offered this profound insight:

”The reason why rivers and seas receive the homage of a hundred mountain streams is that they keep below them. Thus, they are able to reign over all the mountain streams. So, the sage, wishing to be above men, put himself below them; wishing to be before them; he put himself behind them. Thus, though his place be above men, they do not feel his weight; though his place be before them, they do not count it as an injury.”

So, it is with humankind. Those who wish to yield the greatest influence will unselfishly position themselves below others, so as to serve them better.

Bruce Barton, a former New York State Congressman, told a parable of two seas in Palestine that expounds on the wisdom of Lao-tse.

One sea is fresh. Fish live in it. Trees and bushes grow near it. Children splash and play in it. The river Jordan flows into this sea with sparkling water from the hills. People build their homes near it. Every kind of life is happier because it is there.

The same river Jordan flows south in another sea. Here there are no fish, no green things, no children playing, no homes a-building. Stale air hangs above its waters, and neither man nor beast will drink of it. What makes the difference between these neighbor seas? Not the Jordan River. It empties the same good water into both. Nor is it the soil or the countryside.

The difference is that the Sea of Galilee receives water but does not keep it. For every drop that flows in, another drop flows out. The giving and the receiving go on in equal measure. The other sea hordes its income. Every drop it gets, it keeps. The Sea of Galilee lives and lives. The other sea gives nothing. It is called the Dead Sea.

There are two kinds of people in this world – those Dead Sea people who take without giving back, and the givers who remain fresh and vibrant by freely sharing of themselves. Which will you be?

Wrap Up

Part of being a Brother in Sigma Nu is making a commitment to improving others and the community in which you will live and work. Making a difference is the only way that we will continue to improve this county and the world. Sigma Nu can lead the way in this effort if you and you brothers are willing to make the commitment

As a Sigma Nu brother, you have the opportunity to be a servant leader and make a difference in all the groups you are involved with, as a business leader, a community member, as a member of your profession, as a teacher, as a member of your family. It is our hope that you will go out and give of yourself, find the potential in others and build on it, identify areas where you have a passion and go and make a difference.

Reflection Questions & Application Ideas

Reflection Questions

- How have you been helped by older members to grow and develop as a leader and individual?

- How can you help others in the chapter to grow and develop as leaders and individuals?

Application Ideas

- As a group of Phase IV participants, come up with a listing of characteristics or attributes of a successful and contributing alumnus member. Challenge yourselves to live up to these standards as young alumni.

- As a group of seniors, choose a service organization that you believe in and can commit to giving at least 2 hours a month.

- After a chapter service event, spend some time leading a discussion of chapter members reflecting on the event, its impact, and its relation to the values and purpose of the Fraternity.

- As a group, organize an informational event or campaign to help create awareness about the issues addressed by a local non-profit organization (e.g. Boys & Girls Club, Crisis Center, Soup Kitchen).

Tough Decisions

This session is designed to help you better understand the importance of effective money management as you begin your life after school, making decisions that will affect the rest of your life. While that may seem a bit dramatic, listen to the stories of Sigma Nu brothers and how their financial decisions helped shape their lives and future decisions.

Chad: Chad came from a lower-income family. He always had to work hard for his money. In his first three years of college, he worked a part time job to help pay for expenses and borrowed a total of $15,000 in student loans. He rarely ate out, and on the weekends, when some of his brothers were going out to eat at restaurants, he cooked for himself at home. He applied for one credit card and used it only when he knew he could pay it off right away when the bill came. He graduated with $0 on his credit card. Once he started his job, he started saving part of his paycheck, made plans for a car, and invested $150 a month.

Bryan: Bryan came from a middle-income family and a town that was fairly affluent. He always had a job in high school and in college during the summer, but usually spent more than he had. In college, he always ate out and rang up big bar tabs on the weekends. He spent money whenever he wanted, bought CD’s each week and liked to show off the new Ford Explorer that his parents bought him. He applied for several credit cards during his sophomore year and by his senior year, had three cards that all had balances of $1,000 or more on them. Bryan also had student loans totaling more than $25,000. He planned on using his signing bonus ($1,000) from his new job to buy a new mountain bike and pay some of his credit cards.

The decisions that these two brothers made had dramatic impacts on their financial futures, and with their stories serving as examples, it is hoped that you begin to develop tools to make good financial decisions for yourself.

Credit and Spending

Among the class of 2018, 69% of college students took out student loans and they graduated with average private and federal average debt of $29,800. Americans owe over $1.5 trillion in student loan debt, more than $500 billion more than total U.S. credit card debt.

If you are like the average American, you have over $7,697 in credit card debt (as of 2018). Although a typical college student in 2016 had only $2,573 in credit card debt, that’s on top of an average student loan debt of around $30,000.

It seems that most of America has a love affair with debt. While student loans and credit cards may be necessary for most students to fund their education and living expenses while in school, these tools are very powerful and can be used for both good and evil.

Credit cards are powerful, but you have to be careful about using the plastic too much. Credit card companies make a lot of money off of individuals who overuse their cards and cannot pay off their balance at the end of each month; therefore, it is imperative that you think about what you’re purchasing with your credit card before handing it over to the sales clerk or punching your number into the computer.

Credit Card Quiz

Test your debt and credit savvy. Answer the following questions to see how your debt and credit awareness rates. With so many college students struggling to make ends meet, credit wisdom can mean the difference between financial success and failure. Give yourself the number of points in parentheses for each statement that is true for you. Total your points at the end to see where you rank.

- You know, to the penny, how much you owe on each card in your wallet as well as the cost of recurring subscription fees for services you use like Spotify, Netflix, and Amazon Prime. (1)

- You know, to the dollar, how much you owe on each card in your wallet, as well as the cost of recurring subscription fees for services you use like Spotify, Netflix, and Amazon Prime. (2)

- You know a ballpark figure for all of your cards and recurring services combined, and a few individual cards. (3)

- You know a ballpark figure for all of your cards and recurring services combined, but not for any single one. (4)

- You don’t have a ballpark figure for one, let alone all of your cards and recurring services. (4)

- You pay your balances off in full each month. (1)

- You sometimes pay off your balances in full. (2)

- You rarely pay off your balances in full. (4)

- You are surprised to hear that anyone pays his or her balances off in full. (4)

- You always pay more than the minimum monthly payment of every credit card. (1)

- You sometimes pay more than the minimum monthly payment on every credit card. (2)

- You sometimes pay more than the minimum monthly payment on some credit cards. (2)

- You seldom pay more than the minimum monthly payment on some credit cards. (3)

- You never pay more than the minimum monthly payment on your credit cards. (3)

- You sometimes don’t pay even the minimum monthly payment. (4)

- You only use your credit cards for emergency use. (1)

- You use your credit cards for occasional purchases. (2)

- You use your credit cards on a regular basis for unnecessary purchases. (3)

- You use your credit cards to supplement your income in order to purchase a better life. (4)

- You create a new charge only when the previous balance is paid in full. (1)

- You sometimes create a new charge when your previous balance is paid in full. (3)

- You charge regardless of whether or not the previous balance is paid in full. (4)

- You charge in spite of the fact that you have never paid off your previous balance in full. (4)

- You think a credit card is a necessity. (1)

- You think using a credit card is a right. (3)

- You think your credit card limit is too low. (3)

- You think it is impressive to have a card with an annual fee (e.g. gold or platinum card, card with significant perks). (4)

- You’ve used student loan dollars to pay for something other than tuition and living expenses (e.g. a night out, spring break, or a gift for yourself). (3)

Scoring for the Credit Card Quiz

1-5 A You’re in good shape

6-10 B Better than average, but can improve

11-15 C Average, with potential for problems

16-20 D In trouble, need to take measures to improve

21+ F ACT NOW, GET HELP!!!

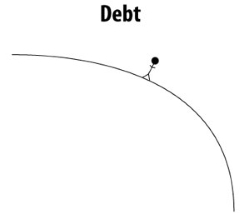

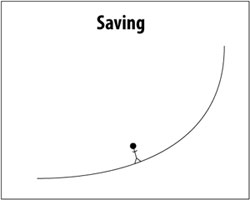

Debt

Debt is part of life, especially for graduating college students.

Knowing your credit limit is the key to keeping you out of financial trouble and filing for bankruptcy, as three-quarters of a million Americans did in 2018. In developing a plan for financial success, you need to decide how much debt you can afford by creating a spending plan and sticking to it. Remember, in order to save for the future, you have to pay for the past.